Key Points:

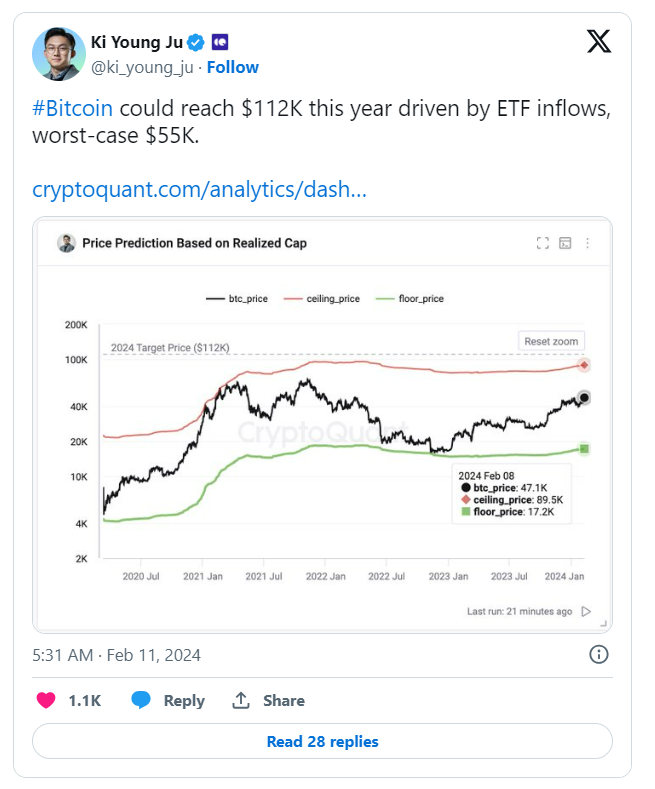

- CEO of CryptoQuant, Ki Young Ju, forecasts Bitcoin’s price to soar up to $112,000 by the end of 2024, driven by anticipated inflows from Spot ETFs.

- A potential monthly inflow of $9.5 billion from ETFs could augment Bitcoin’s actual value by $114 billion, potentially propelling the price to $112,000.

- Ju presents an optimistic projection ranging from $104,000 to $112,000, with a more conservative estimate between $55,000 and $59,000.

In an insightful analysis shared by CryptoQuant CEO Ki Young Ju, Bitcoin is poised for a remarkable ascent to $112,000 in 2024, primarily fueled by the anticipated influx of funds from exchange-traded funds (ETFs). Highlighting the pivotal role of ETF cash inflows, Ju predicts a monthly surge of $9.5 billion, augmenting Bitcoin’s actual capitalization by a staggering $114 billion annually.

Ju’s forecast paints a bullish picture of Bitcoin’s trajectory, envisioning a potential surge to $112,000 by the year’s end. Despite speculation regarding possible exits from Grayscale Bitcoin Trust (GBTC), Ju remains optimistic about Bitcoin’s price rally, projecting a substantial increase of $76 billion in accurate capitalization. This could elevate Bitcoin’s current capitalization from $451 billion to between $527 billion and $565 billion.

Ju remains confident in Bitcoin’s resilience despite potential fluctuations, foreseeing a price range between $104,000 and $112,000 fueled by ETF inflows. Even in a more conservative scenario, Bitcoin could still maintain a strong position, trading between $55,000 and $59,000.

Amidst this anticipation, Bitcoin is already displaying signs of momentum, with its current weekly candle reflecting a gain of 12.58%. Trading above $48,000, Bitcoin’s volume in the last 24 hours has surged to $20.65 billion, hinting at growing investor interest and market activity.

Source: coinpedia