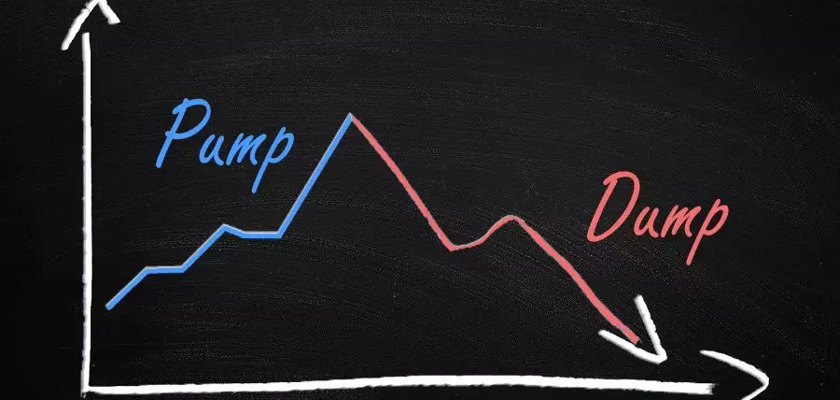

As if Wall Street Hedge funds weren’t enough, pump and dump crypto schemes are shamelessly running wild. Now certainly, this multi-billion-dollar industry was not part of Satoshi’s vision for an unregulated market. But, I guess scammers will scam and having blind hope in a sketchy investment will always have its repercussions. Who would have thunk it? Out of a total of 20,000+ crypto assets, approximately 9000 of them are active and or hold some value. The question is, how many of them are pump and dump crypto scams? New statistics reveal that a terrifying number of new altcoins are straight up scam. And while the scams are a short-term reality check, the scary question is how many of the non-scam assets are trash with no actual utility.

Pump and Dump Crypto for Elon’s Sake

Recent data from Chainalysis reveals that almost one on four new crypto tokens have clear pump and dump attributes. Keep in mind that launching a token has a lot less requirements and is noticeably easier. With that, the number of tokens launching on chains is insanely high.

According to the analytics firm, a quarter of new tokens were pump and dump crypto schemes. As bad as that sounds, here comes the worst part. Over 1.1 million tokens launched on Ethereum and BNB blockchains in 2022. Consequently, only 40,521 of those tokens had “a minimum of ten swaps and four consecutive days of trading in the week following their launch.”

Here’s the thing, a minimum of ten swaps and four consecutive days of trading is a disgraceful tragedy for a token. Even with that low standard, only 3.6% of these new tokens managed to pass the bar.

Essentially, Chainlaysis looked at set of crypto assets that “had an impact on the crypto ecosystem”. They analyzed which ones lost at least 90% of their value in their first week of trading, which suggests the token creators dumped their holdings quickly.

“Of the 40,521 tokens launched in 2022 that gained sufficient traction to be worth analyzing, 9,902, or 24%, saw a price decline in the first week indicative of possible pump-and-dump activity.”

Learn What is Shitcoin

How Long Can This Go On?

Often, we talk about how bureaucratic regulations make life difficult for everyone and cost both the customer and the merchant unfair additional fees. Subsequently, cryptocurrencies kind of became a savior as a new and improved payment method. For the most part, it was the lack of unnecessary regulations that made these improvements possible.

However, while blockchain networks such as Ethereum and Binance make tons and tons of money from new tokens, shouldn’t they somehow remain responsible for all the trash that is launching on them? At the very least, these networks must update their requirements to prevent both pump and dump crypto schemes and valueless endeavors.

Eventually, these embarrassing statistics and disgraceful results will call for immediate action from regulatory bodies. At this point, the SEC has pretty much officially waged war against crypto assets. With the Ripple lawsuit going on for three years and a plethora of new cases against crypto entities, it’s only a matter of time before they take radical steps.

With that, the fate of crypto falls into the hands of irresponsible and greedy CEOs who are in a race to milk as much capital as possible before the inevitable storm of legislation paralyze the industry.

Perhaps, it is not too late for large blockchain networks to get their act together. But, if history has taught us anything, dot com bubbles are like Thanos, they are inevitable!