The role of cryptocurrency in the failures of banks Silvergate, Silicon Valley, and Signature has been highlighted in a recent report by the Congressional Research Service (CRS). The report examines the impact of crypto on the US banking crisis and reveals that the banks’ exposure to crypto was minimal, but the perception of risk “may have driven non-crypto firms/individuals to make significant withdrawals.” Interestingly, the statement sheds light on a critical issue regarding crypto assets. Despite all the bullish predictions, the failure of crypto-friendly banks outlines the severe lack of trust in crypto still dominant among retail investors.

Learn How to Exchange Cryptocurrency to PayPal

Limited Exposure to Crypto

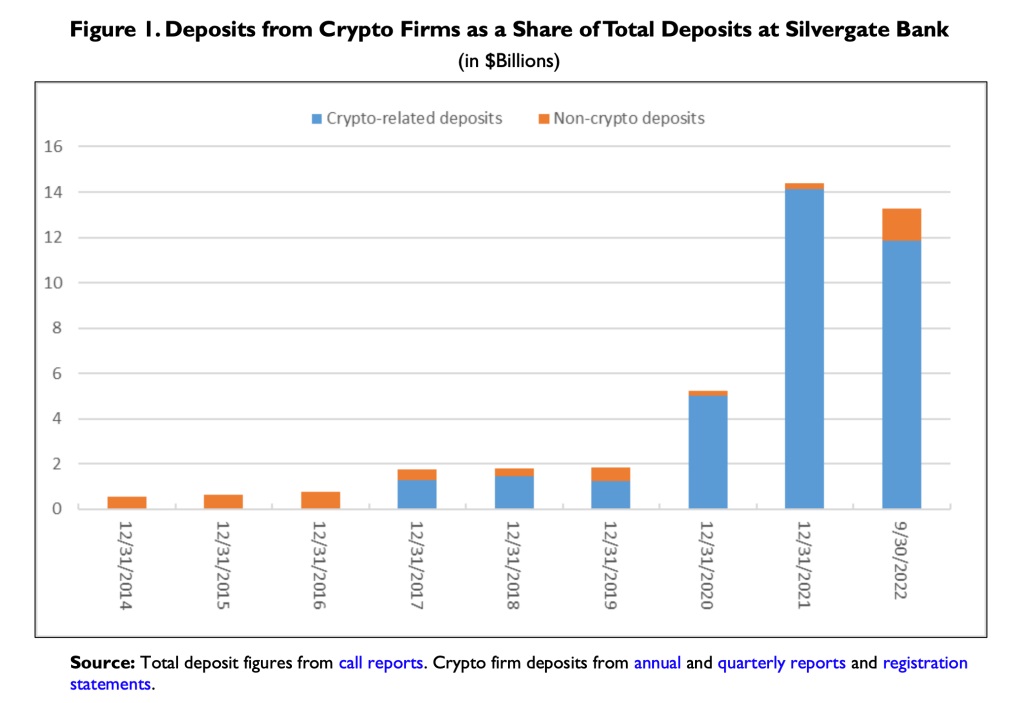

According to analyst Paul Tierno from CRS, the banks’ exposure to crypto “was somewhat limited.” Tierno noted that “volatility in crypto markets may expose banks to liquidity risks that could ultimately lead to fatal losses.” However, it was the dwindling deposits from crypto firms that led banks to sell securities at a loss, exacerbating liquidity issues and solvency.

In November 2021, the crypto market reached an all-time high of around $3 trillion. However, by December 2022, the market lost more than two-thirds of its market capitalization. The report highlighted that the fall in digital asset prices led to centralized crypto platforms and stablecoin issuers experiencing redemptions, causing them to draw down deposits held at these banks.

To meet the withdrawal demand, banks sold securities for losses, affecting their liquidity and, in some cases, solvency. For instance, Silvergate’s deposits fell by over half, while Signature’s deposits dropped by 15% in Q4 2022. The CRS report emphasized that the losses were not realized on crypto-related assets but were caused by crypto deposit withdrawals.

Crypto’s Impact on US Banking Crisis

The CRS report reminds us that the crypto market chaos affected US bank stocks. SVB, Silvergate, and Signature were pushed over the edge by fear, uncertainty, and doubt. The report concluded that “banks must be prepared for the potential of rapid withdrawal of deposits. This can exacerbate liquidity issues and, ultimately, threaten solvency.”

In conclusion, the CRS report serves as a reminder that the crypto market’s volatility can impact US banks. Although the banks’ exposure to crypto was limited, the perception of risk was enough to drive non-crypto firms/individuals to make significant withdrawals, leading to the banks selling securities at a loss. This affected their liquidity and, in some cases, their solvency.

However, it’s also important to analyze the fear and the lack of trust in crypto. Perhaps, the volatility is the key factor here. Yet, the FTX collapse, may have been a big wake up call for investors. Portraying how easy it is to run a multi-billion dollar scam, Sam Bankman-Fried may have permanently stained the face of crypto. considering this congressional report, we can see how limited exposure to crypto can have negative effects on their business. With all that in mind, we can see how banks may be hesitant to integrate crypto asset into their systems.